9 Easy Facts About Eb5 Investment Immigration Explained

9 Easy Facts About Eb5 Investment Immigration Explained

Blog Article

Excitement About Eb5 Investment Immigration

Table of ContentsMore About Eb5 Investment ImmigrationThe 25-Second Trick For Eb5 Investment ImmigrationThe Ultimate Guide To Eb5 Investment ImmigrationThe 10-Minute Rule for Eb5 Investment ImmigrationEb5 Investment Immigration Things To Know Before You Buy

While we make every effort to supply exact and updated content, it must not be taken into consideration lawful advice. Immigration legislations and laws go through transform, and individual circumstances can differ extensively. For individualized advice and legal recommendations regarding your certain immigration scenario, we strongly recommend speaking with a certified immigration lawyer that can offer you with customized assistance and ensure compliance with existing laws and guidelines.

Citizenship, via financial investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Backwoods) and $1,050,000 somewhere else (non-TEA areas). Congress has actually authorized these amounts for the next five years beginning March 15, 2022.

To get the EB-5 Visa, Investors need to produce 10 full-time united state tasks within two years from the day of their full investment. EB5 Investment Immigration. This EB-5 Visa Demand makes certain that investments add straight to the U.S. job market. This uses whether the jobs are created straight by the business enterprise or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

How Eb5 Investment Immigration can Save You Time, Stress, and Money.

These work are determined via versions that use inputs such as development expenses (e.g., building and equipment costs) or yearly revenues generated by ongoing operations. On the other hand, under the standalone, or straight, EB-5 Program, just straight, permanent W-2 staff member placements within the company might be counted. An essential risk of depending entirely on direct workers is that staff decreases as a result of market conditions could cause insufficient full-time settings, possibly resulting in USCIS rejection of the capitalist's application if the job development demand is not met.

The financial model then forecasts the number of direct work the brand-new organization is most likely to produce based upon its anticipated revenues. Indirect jobs determined through financial designs describes work created in markets that provide the products or solutions to business straight involved in the project. These jobs are produced as a result of the increased need for products, products, or solutions that support business's operations.

Rumored Buzz on Eb5 Investment Immigration

An employment-based fifth choice classification (EB-5) financial investment visa supplies an approach of becoming an irreversible U.S. citizen for foreign nationals intending to invest funding in the United States. In order to make an application for this copyright, an international investor should invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Area") and produce or maintain a minimum of 10 permanent jobs for United States employees (leaving out the capitalist and their instant family members).

Today, 95% of all EB-5 resources is raised and spent by Regional Centers. In lots of additional reading areas, EB-5 financial investments have actually filled the financing space, giving a new, vital resource of funding for regional financial growth tasks that rejuvenate communities, create and sustain tasks, facilities, and services.

The Facts About Eb5 Investment Immigration Uncovered

workers. Furthermore, the Congressional Budget Workplace (CBO) racked up the program as revenue neutral, with administrative costs spent for by applicant fees. EB5 Investment Immigration. More than 25 countries, consisting of Australia and the UK, usage similar programs to attract foreign investments. The American program is a lot more strict than many others, calling for substantial risk for investors in terms of both their economic investment and migration condition.

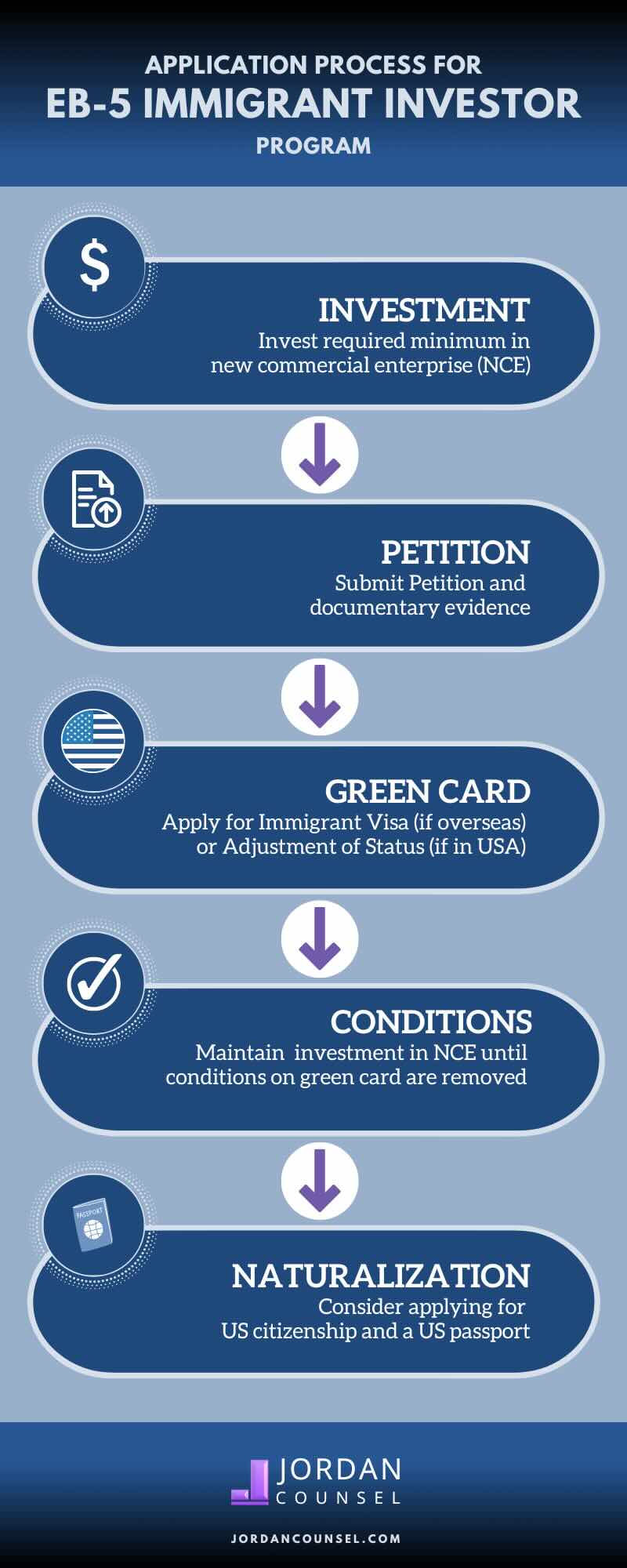

Family members and individuals who look for to move to the United States on a long-term basis can apply for the EB-5 Immigrant Investor Program. The United States Citizenship and Migration Services (U.S.C.I.S.) set out different requirements to get irreversible residency via the EB-5 visa program.: The first step is to locate a qualifying investment opportunity.

When the possibility has been recognized, the financier needs to make the investment and submit an I-526 request to the united state Citizenship and Migration Services (USCIS). This application must include evidence of the investment, such as financial institution statements, purchase contracts, and business strategies. The USCIS will assess the I-526 request and either authorize additional hints it or request added proof.

Eb5 Investment Immigration Things To Know Before You Buy

The investor should get conditional residency by submitting an I-485 application. This petition must be sent within six months of the I-526 approval and should include proof that the financial investment was made which it has developed a minimum of 10 full time tasks for U.S. workers. The USCIS will certainly examine the I-485 petition and either approve it or demand additional evidence.

Report this page